Understanding Market Downturns

Since 1980 there have been:

- 12 Corrections - Declines of 10% or more

- 8 Bear Markets - Declines of 20% or more, at least two months long

- 5 Recessions - Declines in economic conditions for two or more successive quarters (refers to declines in the broad economy rather than the financial markets, though the two can be linked).

Source: Vanguard.

For prepared investors, market downturns can represent great opportunity.

Nearly everywhere you turn, from friends and colleagues to cable news shows, you can find someone with a strong opinion about the financial markets. People will often use specific terms such as correction or bear market to render judgments about the direction of markets, especially when market performance is choppy or trending down.

Is it worth getting concerned when markets stop or even reverse their upward advance?

To answer that, it’s important to realize that downturns are not rare events: Typical investors, in all markets, endure many of them during their lifetimes.

Even knowing this, it can be unsettling to witness the decline of your portfolio during one of these events. After all, that account balance is more than a number—it represents very important personal goals, such as the ability to retire comfortably or to provide a quality education for family members. When market conditions place those goals in jeopardy, you may feel compelled to do something, such as sell most or all of your investments. You may assume that converting to cash will give you a better long-term result than staying invested.

But such action would shut you out of the strong recoveries that have historically followed market downturns. The answer is to come up with a game plan before the next market pullback, so you’re well-positioned to try to take advantage of the opportunities that follow. What’s more, you’ll probably know what to expect as markets cycle through their phases, so you can tune out messages that don’t help your strategy.

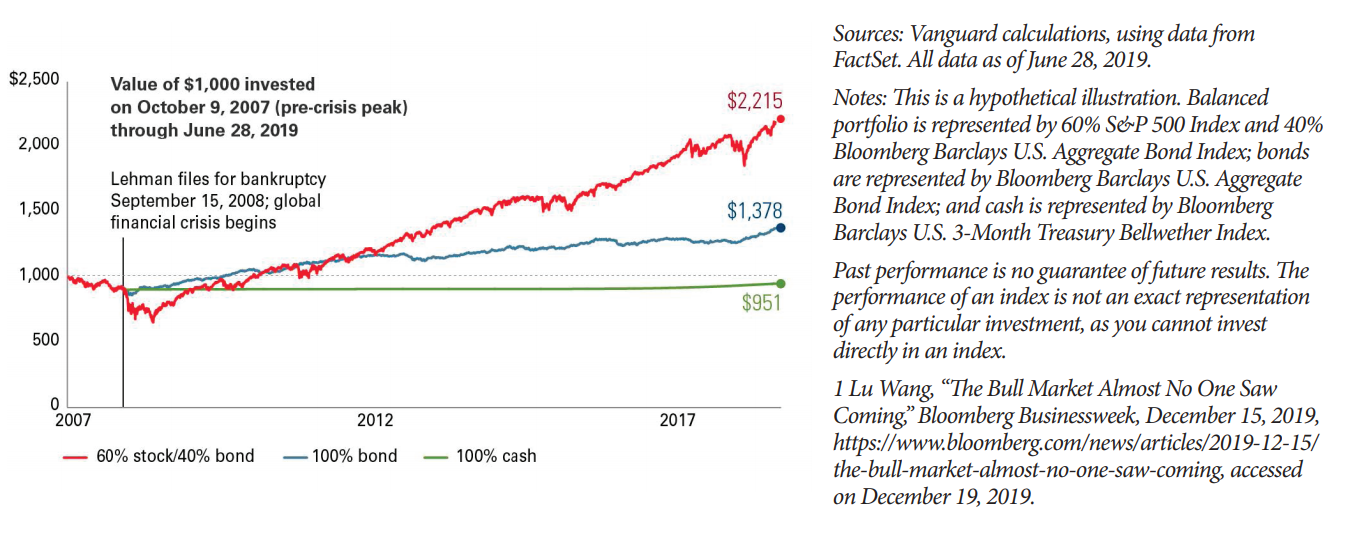

It’s worth noting that not all financial declines are the same in length or severity—for example, historically speaking, the global financial crisis and Great Recession of 2008–2009 was an extreme anomaly. As challenging as that event was, it was followed by the longest stock market recovery in U.S. history.1

Value of $1,000 invested on October 9, 2007 (pre-crisis peak) through June 28, 2019. Lehman files for bankruptcy September 15, 2008; global financial crisis begins. Value of $1,000 invested in 60% stocks/40% bonds, 100% bonds, and 100% cash was approximately $900 each. By 2012, the stock/bond investment and the bond investment were both worth about $1,125 each and the cash was valued at around $900. In 2017, the stock/bond investment was valued at about $1,850, the bond investment climbed to $1,200, and the cash was worth $925. On June 28, 2019, the $1,000 stock/bond investment was worth $2,215, the $1,000 bond investment reached $1,378, and $1000 cash was valued at $951.

Sources: Vanguard calculations, using data from FactSet. All data as of June 28, 2019.

Notes: This is a hypothetical illustration. Balanced portfolio is represented by 60% S&P 500 Index and 40% Bloomberg Barclays U.S. Aggregate Bond Index; bonds are represented by Bloomberg Barclays U.S. Aggregate Bond Index; and cash is represented by Bloomberg Barclays U.S. 3-Month Treasure Bellwether index.

Past performance is no guarantee of future results. The performance of an index is nto an exact represntation of any particular investment, as you cannot invest directly in an index.

1 Lu Wang, "The Bull Market Almost No One Saw Coming," Bloomberg Businessweek, December 15, 2019, https://www.bloomberg.com/news/articles/2019-12-15/the-bull-market-almost-no-one-saw-coming, accessed on December 19, 2019.

Best defense: Making a plan and sticking to it

We can develop a plan now that prepares you and your portfolio for financial system shocks, whenever they happen to occur. That means focusing on the factors of your investing strategy we can control (including things such as asset allocation and costs) and not worrying about those things out of our control, such as downturns in the markets and economy.

In the meantime, remember that bearish market conditions—while inevitable—don’t last forever. As a savvy investor, you can ignore short-term pullbacks of the market (and any commentary that might cause you to veer off course) and remain committed to achieving your long-term vision.

Downturns come and go. The results of a well-designed and faithfully followed plan, on the other hand, can serve you the rest of your life.

In coming up with the best plan for you, it is helpful for you to think about the following:

- How do you feel about risk? Are you OK with a greater amount of up-and-down movement in your portfolio if it means potentially higher returns? Or, alternatively, would you rather have more stability in your portfolio even if it means forgoing higher returns?

- we can adjust your portfolio’s risk profile to a level appropriate for your personal risk-comfort level and investing objectives.

Notes: All investing is subject to risk, including the possible loss of the money you invest.

Mid and small-capitalization stocks historically have been more volatile than large-cap stocks.

Investments in bonds are subject to credit, interest rate, and inflation risk. High-yield bonds present higher credit risk than other types of bonds.

Be aware that fluctuations in the financial markets and other factors may cause declines in the value of your account. There is no guarantee that any particular asset allocation or mix of funds will meet your investment objectives or provide you with a given level of income.

Investment products and services are offered through Wells Fargo Advisors Financial Network, LLC (WFAFN), Member SIPC, a registered broker-dealer and a separate non-bank affiliate of Wells Fargo & Company. Wurm & Frye Wealth Management is a separate entity from WFAFN.

Special Offer!

Click below to request your FREE copy of

The Most Common Retirement Mistakes.